Investments

MWPF INVESTMENTS

Objectives, Approach and Performance

Our Investment Objectives

The Fund offers members a single default portfolio that seeks to deliver a real return of 4.5% above inflation (CPI + 4.5%) over any consecutive five-year period at a minimum level of risk. This target level of return is the outcome of a stochastic liability-driven

modelling exercise to determine the most appropriate level of return target suitable for the membership profile of the Fund.

Our Investment Approach

The Fund utilises a Core-Satellite approach to meet the investment objective of CPI + 4.5% over any consecutive five-year period. The total Fund is managed as a combination of a Core Portfolio (Core) and a Market

Linked Portfolio (Satellite). The strategic weighting between the Core and the Market Linked Portfolio is 30% and 70% respectively:

Life Stage Model

A member’s retirement savings is invested in the current Core and Market-Linked portfolios until five years before the member’s normal retirement age. Thereafter it will be switched to the pre-retirement age portfolio by default. The switch will take place on the date coinciding with the member’s pre-retirement birthday.

Why the switch?

When a member is still young and far from retirement, they have time and the appetite to take more risk by investing their money in a more aggressive or risky portfolio. But when the member is closer to retirement, they cannot afford to lose capital and also do not have enough time to recover the investment losses they would have suffered had their capital remain invested in the markets.

How the Life Stage Investment Model works

- MWPF has two additional investment portfolios where 50% of the member’s fund credit will be transferred into, five years before normal retirement age, facilitating a seamless transition to retirement.

- The one additional investment portfolio will also be used as the savings pot investment portfolio, fulfilling the requirements of the “two-pot” retirement system when it gets implemented.

Allocation of a member’s fund credit to the different life stages with the Fund’s default investment strategy:

| Until 5 years before retirement | 5 years before retirement |

| All fund credits invested in the Accumulation Portfolio | A safer portfolio that protects both your income and capital. |

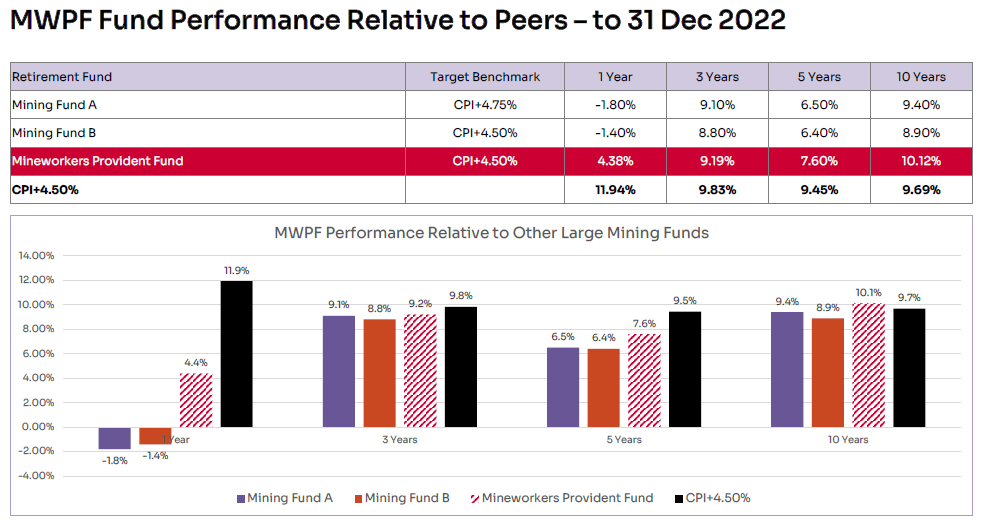

We outperform our competitors

The Fund has outperformed all industry peers (with the same investment objectives) over three, five and 10 years respectively. The Fund also stacks up favourably over one year as it remains in the top three

Funds when compared to peers.

Most importantly, we have achieved these outstanding results with a transformed value chain of service providers demonstrating that transformation makes good business sense!

- Asset Consultant – Majority black-owned managed and controlled (Level 1 contributor)

- Asset Managers – 35% exposure to majority black-owned, managed and controlled (inclusive of black women participation)

As an asset owner, we understand that the power of reform lies with us. Therefore, we continuously review our supply chain and engage our service providers through the setting of transformation targets and ongoing monitoring.