How to claim

HOW TO CLAIM IN THE EVENT OF DEATH - WHAT SHOULD THE FAMILY DO?

A cash lump sum will be allocated to your dependants, in terms of Section 37(C) of the Pension Funds Act.

The benefit will be as follows:

3 x basic annual salary

The total retirement contributions;

Total Voluntary Contributions;

Total Transferred Portion; and

Net investment return.

The above benefit will be taxed as per the Income Tax Act of South Africa.

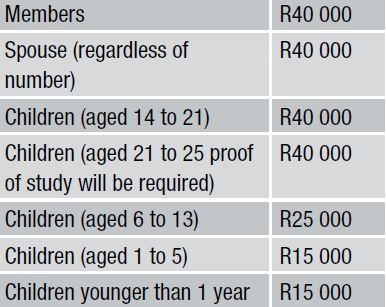

A funeral benefit is payable from the Fund in the event of death a Member, Spouse or children.

Documents required:

Death claim form signed by two Employer authorised signatories and stamped by the mine;

Deceased nomination of beneficiaries form;

Original certified copy of death certificate;

Original certified copy of death certificate from country of origin if not South African, eg Lesotho,Mozambique, Botswana, etc.

Translation of the certified death certificate into English should also be obtained;

Original certified copy of deceased‘s identity document or passport;

Original beneficiaries’ bank statements with bank stamps;

Original certified copy of marriage certificate and original certified copy of identity document or certified copy of passport of the spouse (For marriages registered at Home Affairs after the death of a member,

A customary union letter signed by three of the deceased’s family members before their Chief or Magistrate together with their certified identity documents copies or passport copies should be submitted);

A letter signed by three relatives of the deceased in front of their Chief or Magistrate with certified copies of their identity documents or certified passports copies confirming that the member was never married and had no children;

Beneficiaries’ fully completed affidavit of dependency forms (MW16) signed and stamped by the Commissioner of Oaths listing all minor children must be submitted;

Major children must complete their own affidavit of dependency, signed and stamped by the Commissioner of Oaths;

• All beneficiaries, including major children must submit an affidavit signed and stamped by the Commissioner of Oaths stating clearly the extent of their dependency on the deceased;

Original certified copies of minor children (below 20 years)’s birth certificates, identity documents or passports must be submitted;

Original certified copies of identity documents or passports of major children must be submitted;

Guardian’s original bank statement with bank stamp must be submitted;

All major children still at school must submit a letter from school or the institution confirming that they are still at school;

For children not using the deceased surname:

A letter or affidavit from the deceased family confirming that the children belonged to the deceased must be submitted.

The letter or affidavit must be signed by three of the family members in front of their Chief or Magistrate together with certified copies of their identity documents or passports (Alternatives are maintenance orders or unabridged birth certificates showing names of both parents;

Proof of guardianship from a social worker’s background report for minors not residing with their biological parents must be submitted. The report must be stamped by the social worker;

The benefit payable is as follows:

The increase will be effective from 01 May 2019.

If you die, your next of kin or spouse must report your death to your employer’s Human Resources office. When reporting your death your spouse or next of kin should bring along a certified copy of your death certificate and your identity document. This will ensure that theProcess of paying the funeral benefit is done as soon as possible and that the death benefit claim from the Fund is initiated.

There are many documents that need to be submitted, the sooner this is done the sooner your benefits can be paid.

Summary of claims process :

Complete the claim form

Get the employer to sign the claim form

Prepare and ensure you have all required, supporting documents

Submit the signed claim form with all supporting documents to your HR Office

The claims process::

All documents are received and verified

Claims are investigated by the trustees to determine benefit allocation

Tax calculation is applied

Bank verification is received

Payment is made